Take your client’s business to the next level with our business loans. We work with introducers including commercial finance brokers, financial advisors, corporate partners and accountants. Read our partner stories here.

Please note: Due to the Coronavirus outbreak, Spotcap is currently not assessing new loan applications in the UK.

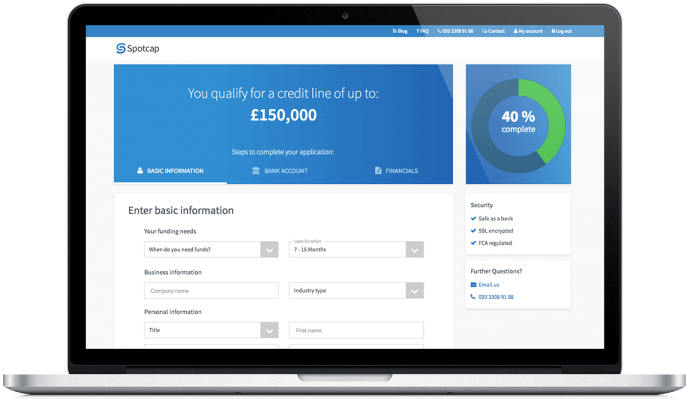

Spotcap’s current clients are still able to log into their dashboard as usual.

For further information and how to contact us click here.