Running a successful dental practice is a delicate balance between meeting the needs of patients and keeping a close eye on finances. Pressure on your working capital could be coming from any direction, such as operational costs, paying your staff or upgrading to better technology. Finding the finance for everything can get difficult.

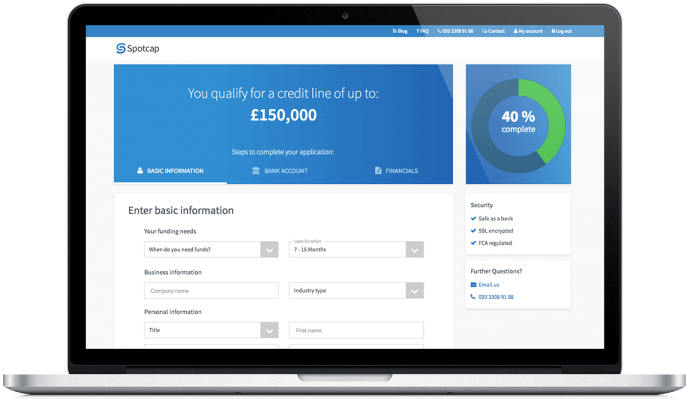

A short-term loan can help. By quickly providing you with the necessary funds, the Spotcap loan allows you to cover all of these expenses without the need to compromise on quality or timing.