Read more about How to Apply.

How does Spotcap work at a glance?

Signup with us

You initiate the business loan application by registering with us and completing a pre-qualification checklist.

GET STARTEDComplete your application

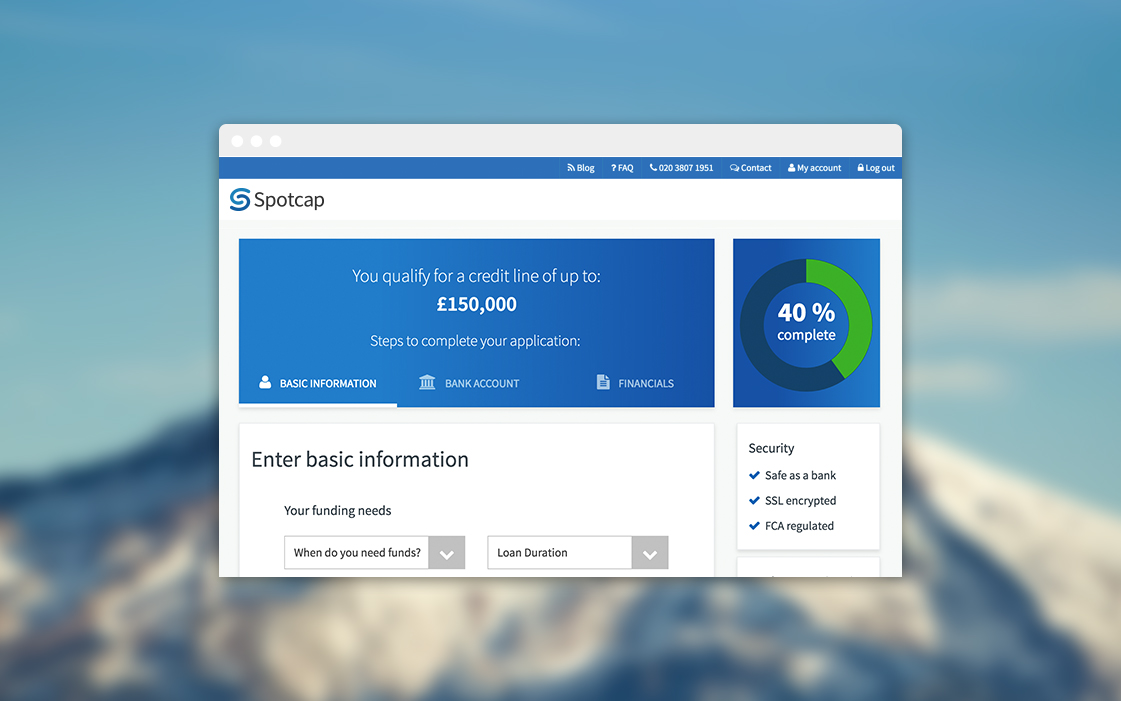

We guide you through the process of uploading the necessary tax, accounting and bank information, while giving us the required personal and business data.

HOW TO APPLY

Complete your application

We guide you through the process of uploading the necessary tax, accounting and bank information, while giving us the required personal and business data.

HOW TO APPLY

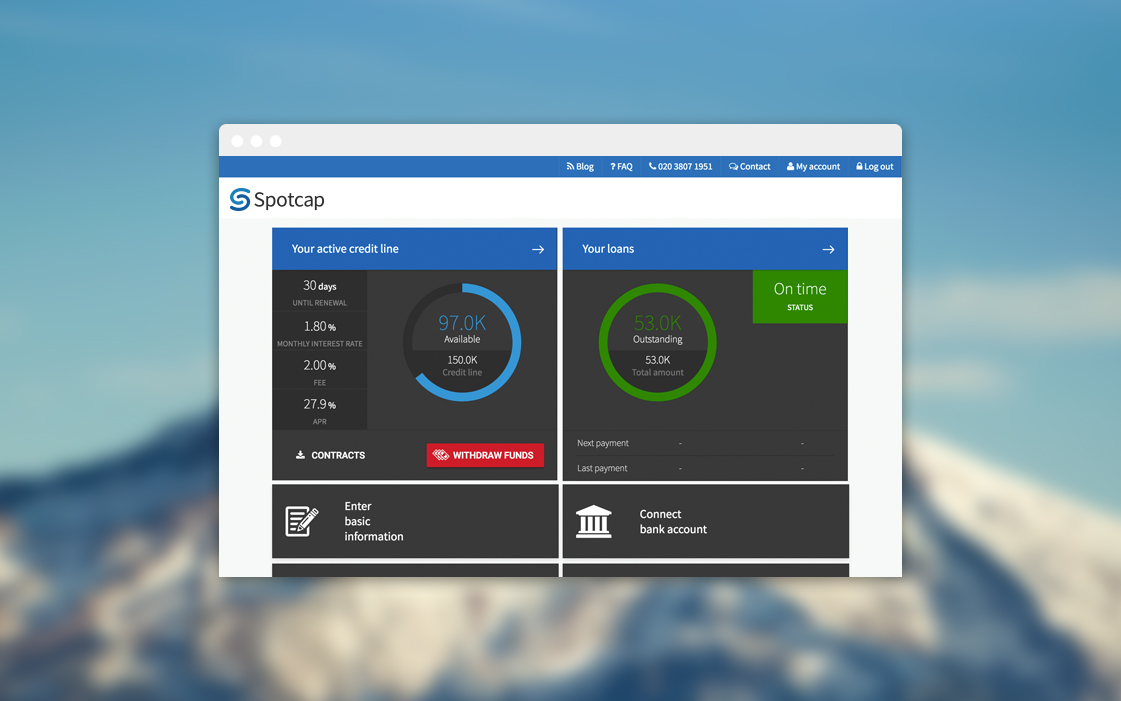

Get approval

Once approved, you can access your business loan within one working day. This allows you to start drawing down finance as you need it.

APPLY NOWHow can finance from Spotcap help

my business?

Our customers use their Spotcap business loans for a variety of purposes.

We’re here to help growing businesses access flexible finance.

Do I qualify for a business loan?

We focus on your recent business performance, assessing the financial health of your business through a unique combination of sophisticated algorithms and specialist assessment. To qualify for a business loan, you need to meet our criteria below.

£9,340

Monthly Repayment

Monthly Repayment

£9,340

Spotcap in the media

"Spotcap’s business is based around new technology to help meet small business needs more efficiently than traditional lenders (...)"

“Spotcap lends to small and medium-sized companies, offering applicants a loan decision minutes after an algorithm rates their creditworthiness.”

"The company uses an innovative credit scoring technology that directly evaluates real-life business data to provide fast and flexible financing."