Commercial Finance Report 2019

In July, Spotcap spoke to over 130 commercial finance intermediaries and collected their views on the current state and future of SME lending. Here is what they had to say.

Please note: Due to the Coronavirus outbreak, Spotcap is currently not assessing new loan applications in the UK.

Spotcap’s current clients are still able to log into their dashboard as usual.

For further information and how to contact us click here.

Spotcap has been a patron of the NACFB since 2016. We regularly attend their events and continuously interact with their members. We are proud to have established strong relationships with NACFB commercial finance brokers, helping them to source the right finance for their clients.

Please note that – due to the Coronavirus outbreak – Spotcap is currently not assessing new loan applications in the UK and therefore not onboarding new partners at present.

For further information and how to contact us click here.

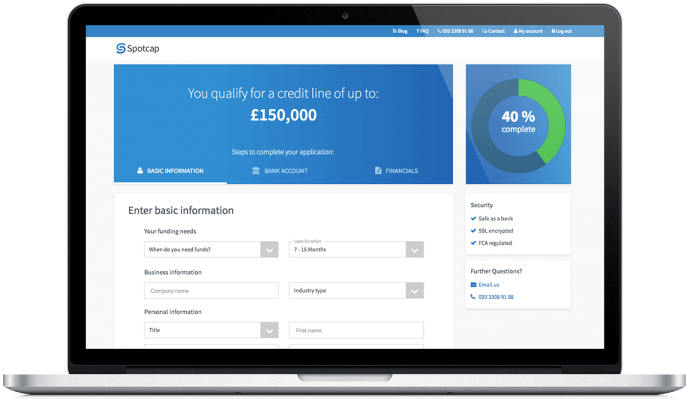

At Spotcap, we provide unsecured business loans for a duration of up to 24 months. Compared to other lenders, we offer loans without a personal guarantee as well as with a full or partial personal guarantee. For group structures we will also accept a corporate guarantee. Our customer service is second to none and we will provide a credit decision within one working day once the loan application is completed.

The amount a business can borrow is based on their turnover, our assessment of their financial condition and how much they request. Our unsecured lines of credit and business loans start at £50k and can go up to £350k.

We understand that firms need access to working capital for many different reasons, and that commercial circumstances can sometimes change quickly. Once a business loan is approved, it’s the choice of the business how it makes use of those funds.

Because the application process is online, and much of it involves only uploading financial reports, an application can be completed in around fifteen minutes. If approved, notification is given within one working day, from which point the funds are available to draw down.

As a partner, you are given access to our proprietary Partner Portal. From here you can apply on behalf of your clients and monitor the application progress. However, you can also refer your clients and they can apply themselves.

Our team is always happy to help. Give them a call on 020 330 89 188, or email [email protected]. We are available Monday to Friday from 9am to 6 pm.