The pace of change in the sector continues to increase, requiring firms to commit to ongoing investments to remain competitive. New technology, new ways of working and changing customer expectations all put pressure on businesses to keep up.

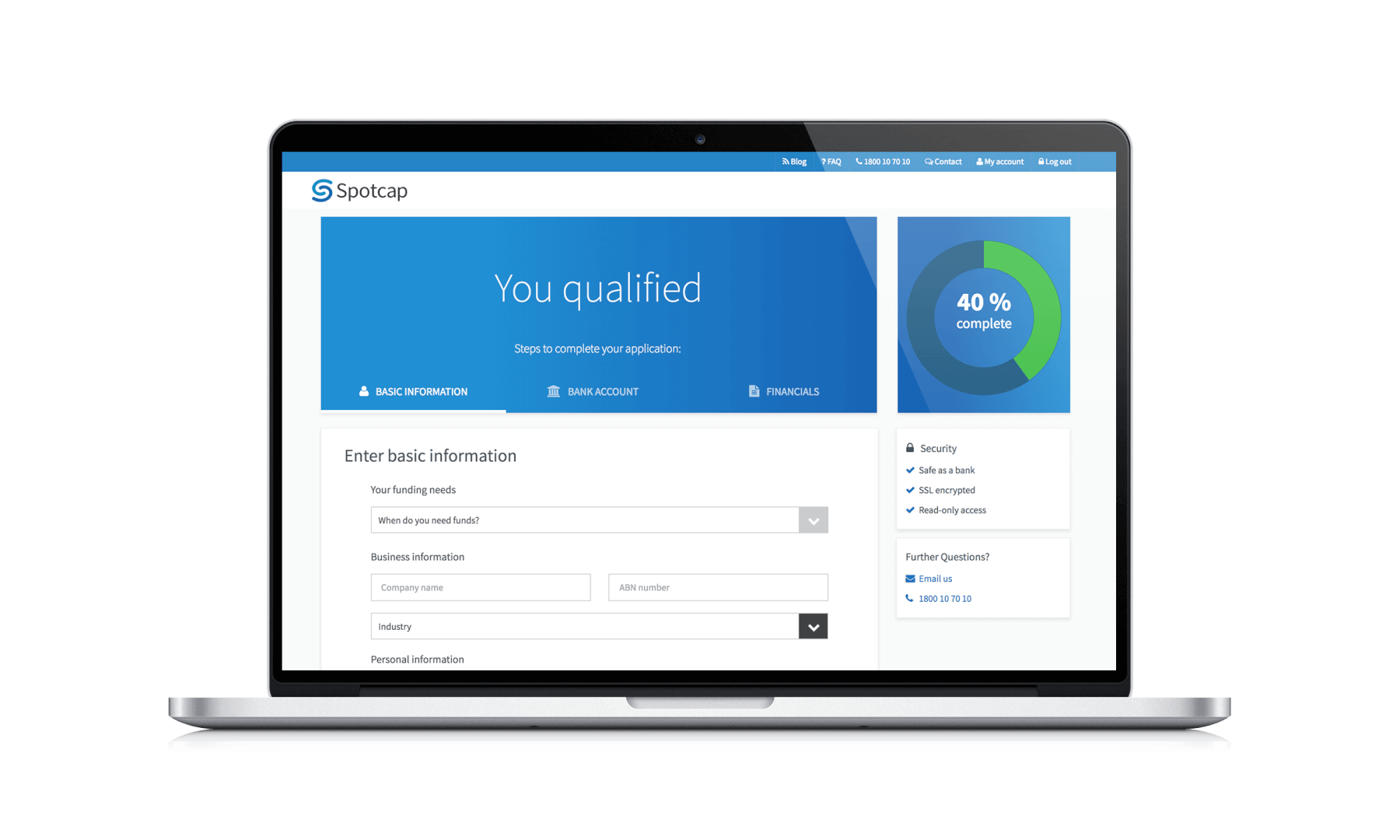

A short-term business loan solution can help. By quickly providing you with the finance you need, a Spotcap loan can fund the investments that will keep you at the cutting edge of your niche.